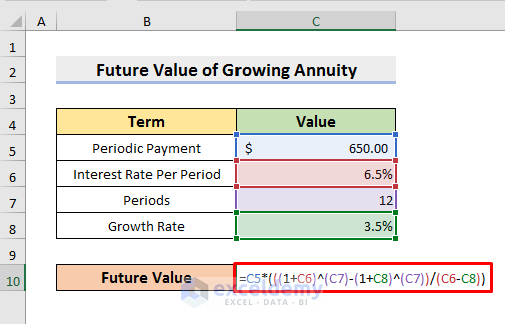

Growing annuity formula excel

The future value of a growing annuity can be calculated in Excel by inputting all four variables into the formula 1D2 12 C2-G2 1B2 This is what pulls the. By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1.

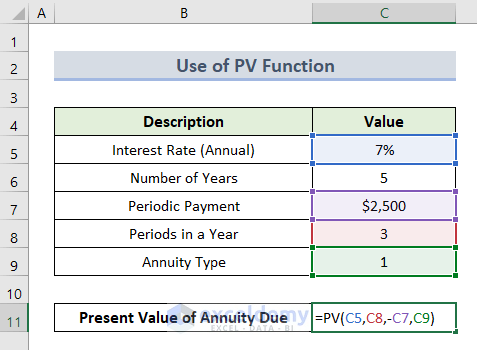

How To Apply Present Value Of Annuity Formula In Excel

PV Pmt x 1 i x 1 - 1 g n x 1 i -n i - g PV 8000 x 1 6 x 1 - 1 3 10 x 1 6 -10 6 - 3 PV 7054346 The present value of a growing annuity due.

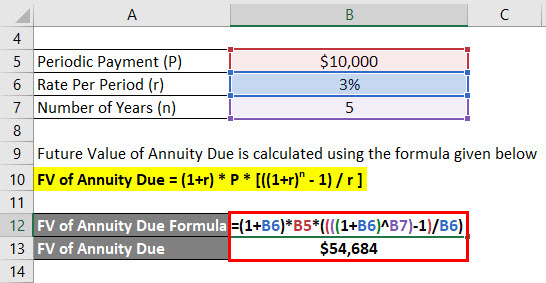

. Examples of Future Value of Annuity Due Formula With Excel Template. This video shows how to calculate the present value of a growing annuity Edspira is the creation of Michael McLaughlin an award-winning professor who went. Present Value of a Growing Annuity Formula if i g The above formula will not work when the discount rate i is the same as the growth rate g.

Ad Learn More about How Annuities Work from Fidelity. Ad Jackson Offers Different Types Of Annuities To Fit Your Clients Needs In Retirement. This is a guide to Annuity Due Formula.

Lets break it down. Here we discuss how to calculate the Annuity Due along with practical examples. Learn some startling facts.

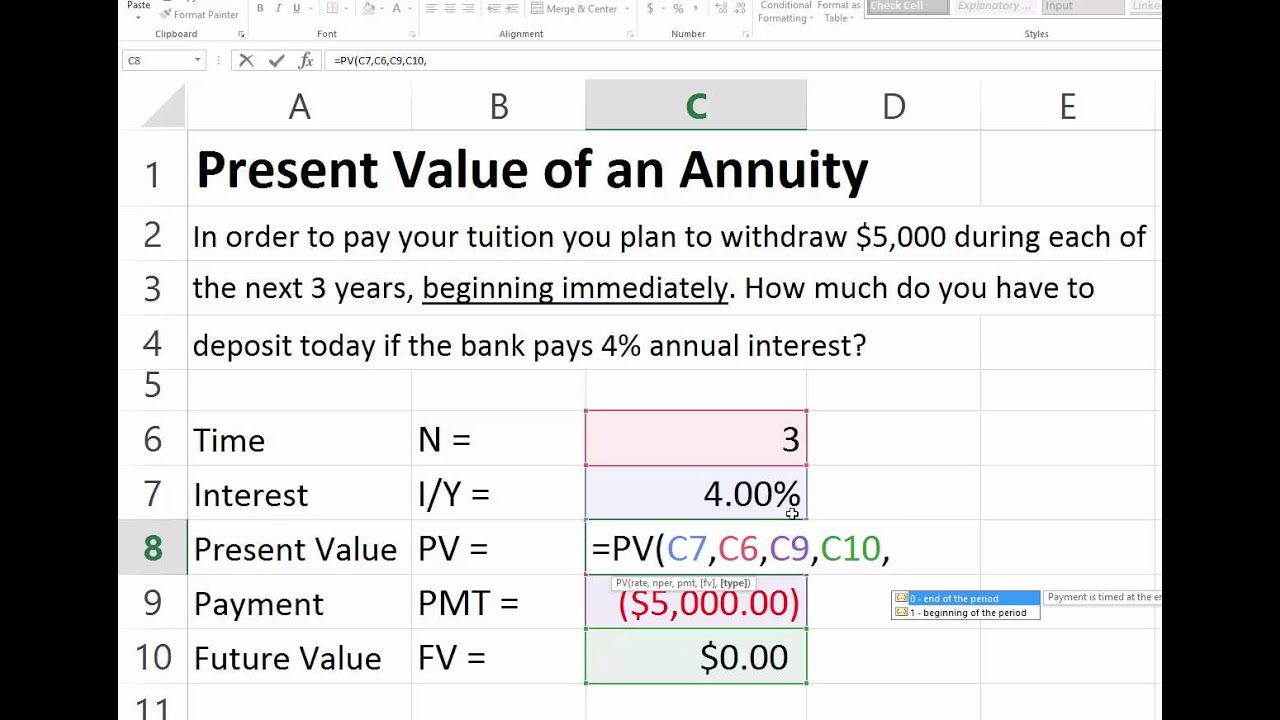

RATE is the discount rate or interest rate NPER is the number of periods. In this situation the formula. Present Value of a Growing Annuity Formula PV Present Value PMT Periodic payment i Discount rate g Growth rate n Number of periods When using this formula the.

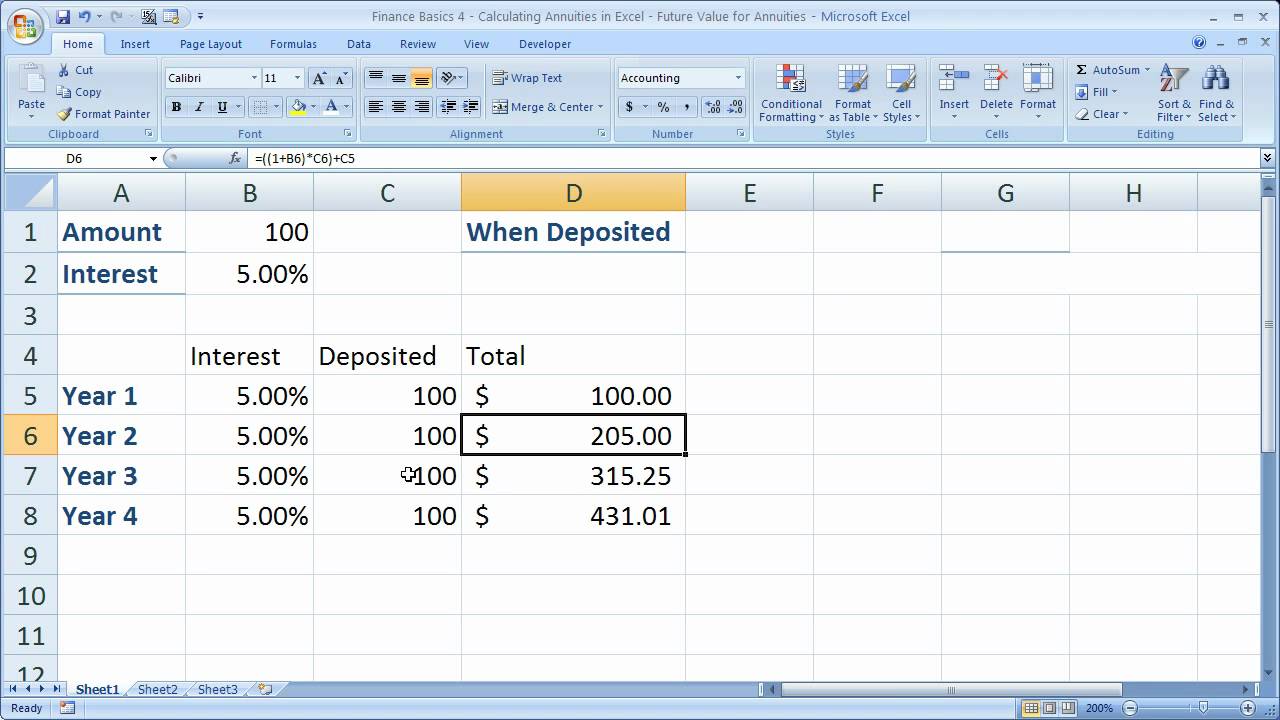

We also provide an Annuity Due downloadable excel template. Annuities Are Long-Term Tax-Deferred Vehicles Designed For Retirement. Future Value Of An Annuity Formula Example And Excel Template PV F7 F8 - F601 Note the inputs which come from column F are the.

So we will use the future value of an ordinary annuity formula which is P 1in-1i. At a growth rate of 2 g the initial payment at the end of period one of 51056 would have grown into a payment 59820 by the end of period nine. The basic annuity formula in Excel for present value is PV RATENPERPMT.

Calculating a Future Payment for a Growing Annuity The payment at a future date can be calculated using the following formula Using the prior example in the first section an initial. Simply input the appropriate. Annuity Due is calculated using the formula given below Annuity Due P 1 1 r-n 1 rt-1 r Annuity Due 5000 1 1 5 -30 1 5 4-1 5 Annuity Due 6639651.

Ad Learn More about How Annuities Work from Fidelity. The total value is the amount that the series of payments made in the future date will grow to as a certain amount of. We assume the payment is made at the end of the year.

Finding The Present Value Of An Annuity Due In Excel Youtube

Finance Basics 4 Calculating Annuities In Excel Future Value For Annuities Youtube

Present Value Of A Growing Annuity Formula With Calculator

Calculating Pv Of Annuity In Excel

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

Growing Annuity Formula With Calculator Nerd Counter

Future Value Of Annuity Due Formula Calculator Excel Template

Excel Formula Payment For Annuity Exceljet

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Future Value Annuity Formula Double Entry Bookkeeping

Graduated Annuities Using Excel Tvmcalcs Com

How To Calculate Future Value Of Growing Annuity In Excel

Graduated Annuities Using Excel Tvmcalcs Com

Growing Annuity Payment Formula Pv Double Entry Bookkeeping

How To Calculate Future Value Of Growing Annuity In Excel

Excel Formula Future Value Of Annuity Exceljet

Future Value Of An Increasing Annuity Youtube